avecigrec

Well-Known Member

Trump has now formally announced his 2024 bid.

He is officially running for president again.

Make America Great Again, Again.

Trump has now formally announced his 2024 bid.

He is officially running for president again.

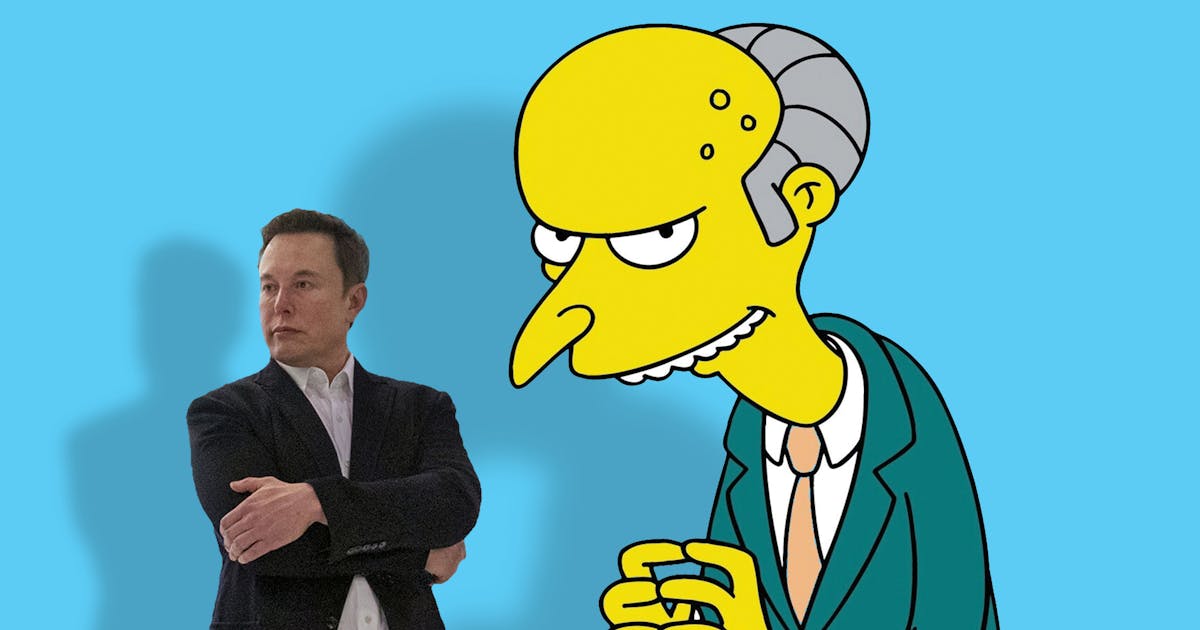

This is a fun quiz:

Who Said It: Elon Musk or Mr. Burns?

The Simpsons character and the guy ruining Twitter often sound a lot alike.newrepublic.com

Trump has now formally announced his 2024 bid.

He is officially running for president again.

This is a fun quiz:

Who Said It: Elon Musk or Mr. Burns?

The Simpsons character and the guy ruining Twitter often sound a lot alike.newrepublic.com

CNN just called the House majority. They have the Republicans taking the majority by a narrow margin.

Damn I just saw that. Here's to hoping the Dems make it to at least 216 or even 2017 so they can make their lives difficult.

I'm all for the left, but 2017 would be way to many Dems!

Not surprising, but very disappointing.Just got a apple news notification about student loan forgiveness from Time.

Time's opinion is the courts will strike down the student loan debt forgiveness before anyone sees any forgiveness.

The courts are very skeptical of executive actions, and based on a precedence set earlier this year by the SCOTUS the executive branch does not have this kind of power. Only congress does.

As of Monday, the student loan debt forgiveness was placed on a indefinite hold by the courts.

Fine with this. More politicians should know when to hang it up.

she´s 82 so probably more than a decade too late alreadyFine with this. More politicians should know when to hang it up.

I feel like I just never will get a head.

Living on my own, when I was trying to keep my student loans up to date with my high rent I ended up building up credit card debt between 4 and 7 years ago to the point where I could not keep up with my student loan payments.

Now that I'm making more money, I have been focusing on trying to pay the credit cards down. And over the last 3 years I feel like I have made no progress, it's all gone to interest and I have just been maintaining my balance even though I'm not charging anything new.

I was starting to make progress, paying about $50 over the minimum each month. I set a fixed payment with bank of america to pay my bill each month $50 over the minimum. Logged into today to make an extra payment and saw that I'm past due and had late fee of $27.

I call them to find out wtf is going on, because my payments have been going through each month. I found out two things. 1, my interest rate isn't fixed and they raised it along with the fed interest rate hikes. And 2, because I have been maintaining my balance and not making progress paying it down my minimum payment has been increased "to help my pay it down". My minimum payment since September is $100 more a month than what it was previously.

I bitched at them for not giving me any notifications of the changes or that my auto payment was insufficient. They were all like, sorry, but that's on you. It's your responsibility to keep up with those things. Not ours to keep you updated. You should be logging in every week keeping up to date with your interest rate and what your minimum due is. Logging in every few months is just plain irresponsible of you and totally on you. They won't waive the late fees.

Before the recession my credit cards wer between 8% and 12% interest rates. After they were all in the ballpark of 18%. Now they are all 24% to 28%. That is just plain highway robbery in my opinion. Other than my bank of america fixed payment coming up short in september and october. I have never missed a payment on any credit card and always have been on time. Why does my interest rates keep having to go up making it harder and harder if not impossible to pay off with my current income to rent ratio.

An, and icing on the cake. This article popped up on my Apple News feed.

It's Now 40% More Expensive to Be Single and Dating Than It Was a Decade Ago — TIME

Singles are spending $117.4 billion on dating every yearapple.news

Yup, just everything is getting insanely more expensive and wages are nowhere close to catching up.

Credit cards are a trap. If you’ve a sizeable balance you’ll never pay it off unless you’re massively overpaying the minimum, the interest is too high. The minimum payment is just interest servicing the credit really. The best advice is take out a consolidation loan if you can. The interest will be lower and there is a defined end date. Cancel the credit card account and cut it up. In 2 to 5 years you should be out of the hole.

I've considered it. But that also would really negatively affect my credit. Because I rent, and don't have a mortgage, my credit score is primarily made up from my credit cards.

My credit score is based on the age of my accounts, on time status, and credit available.

If I close the account that's a negative dig in itself. But then I lose account age and credit available.

To rent most places you need to pass a credit check. So for example, if I close my accounts, then try to move when my lease is up there is a good chance I will not have a high enough credit score to get approved to rent a new place. It's a total trap.