You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Political Discussion

- Thread starter David A.

- Start date

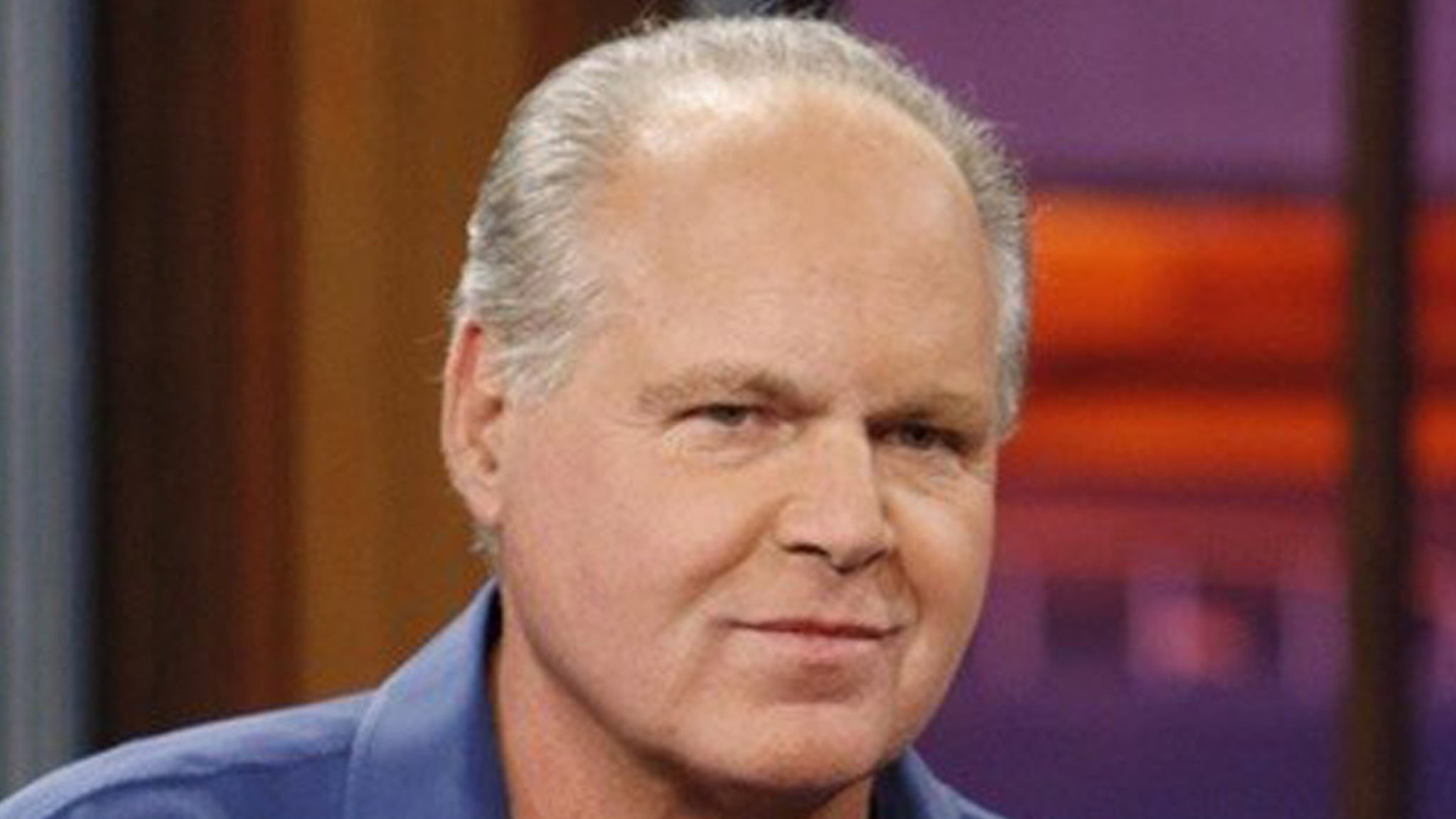

Rush Limbaugh Dead at 70

Rush Limbaugh, the conservative and controversial radio host, is dead at 70.

In state / State schools now have a tuition of $36k in many areas. These aren't private schools or ivy league.

In a Twitter thread last year I remember someone saying "I want to so and so school for only $5,200 a semester. I didn't take out loans and worked hard as a bar tender to pay may way through school. You should be able to do it as well." Then someone asked when did you go to school. This person replied in the 90's. They then responded to him with "You do realize tuition at said school is now $38k alone today. That does not include room and board." That person never did continue the thread after being called out on that.

I went to high school in an all white, affluent rural part of the state. My high school had statistics that 96% of graduates went on to a 4 year degree. In high school guidance councilors never discussed whether or not college was the right choice for you, or if you could afford it. It was always about what school was the best fit for you in terms of academics or sports or amenities and social environment. Several of my classmates went to ivy league schools such as Harvard.

My family wasn't affluent, just average. And my parents were divorced. Even so, going to college was never a question. It was an expectation. You had to go on to college for success. We never had any discussions about costs or whether or not we could afford this. The only discussions we had were to get me motivated to apply to more schools. Right those admission essays and study harder and take those SAT's again for a better grade.

When I was accepted, my father went online and applied for financial aid and student loans without even consulting me or involving me in the process. I'm still pissed at him over that. It was like I got my acceptance letter to my first choice school. I accepted and that night my father tells me financial aid is all taken care of. I was like what.

Tuition for me was $13,000 a semester plus room and board. After financial aid and scholarships I had about $14,000 a year in loans for a total of about $55,000 for 4 years of school.

I graduated in 2008, right as the recession hit. My first job ended after 6 months. The small agency I was working for went under.

I moved back in with my mom and step date and was working 2 retail jobs. I couldn't afford to live on my own. Less than a year of this my step father game me an ultimatum to get a job and move about by x date or you will be homeless. He never went to college, and moved out on his own when he was 18. He used that as an example and didn't want adult children living in his house.

I ended up in retail management because no one was hiring in my field and after rent I couldn't afford student loans. So I used up all of my deferment. Which resulted in my student loans ballooning because of interest. They say using deferment is a poor choice. You should never do that. But I didn't have a choice. It was do that, or be homeless. Getting back into my field at the end of the recession ended up with me working at a start up that failed. So I was jobless once again. Took 15 months to get a full time job in my field again / a job that wasn't a low wage service job. The biggest issue was not having enough experience, and when I could get a job I started at entry level. Again in a situation where I couldn't afford both rent and student loans and fell behind. And that's where I am today. Never being able to catch up because my jobs have been in high rent area. And I didn't have the option of living at home with my parents.

Thank you for the story and I know it won't make it any better but you're definitely not alone on this. I know a slew of graduates from the late 2000s and early 2010s with this exact experience: HS pushes every student to college to promote their 95%+ college acceptance rate and 11M in scholarship numbers, parents push their kids to college as they think/know its the best route to success (often because they don't have it), and we as 18 year olds who can't wash our underwear are getting huge loans signed off on so we can have an experience our friends are having

And you're right, the era of the cheap state school is gone myth. Even states with reduced in-state tuition is still a lot of money. UNH is 15.2k per year for in-state courses, excluding fees and room and board...but when you get the full cost baked in, it's still 35k a year for a resident. That's for one school in the state that is a residential state school (they have a non-residential option in the city too). That's it. NH is notorious for not being great with that, but UMASS, state of all the colleges, is also around there. The only real options to keep costs down are to absolutely kill it on need based aid and scholarships, to have parents fronting the cost, or to put together some combination of community college/online courses to build credits and there's a limit to that. They were certainly not options for me in 2006 - I proposed going to our local low-end community college for a year to keep costs down and got the hardest no I've ever gotten from my mother. She may have been right for me personally but that wasn't a reality. We took on the aid and loans, my mom somehow (I don't ask) pieced together enough for the deposit and got on a monthly plan for some of it.

Around the second semester of my senior year my mother lost her job so I then needed to take on an additional loan - I was lucky it was second semester senior year and not longer than that. I also got lucky to get a job (not a great paying one but a FT job) that helped keep us afloat and parents who let me stay at home forever. I was lucky. I know so many who weren't.

The big issue is that even if we get loan forgiveness...it fixes it in part or whole for us. It doesn't fix it for the next gen who is being given the same song and dance or the severely inflated prices.

But honestly...the deck is severely stacked against millennials and Gen Z at this point and a reckoning will happen in regards to higher ed. It's more a matter of time here. At some point people will see 240k for four years and say "my kid would be better off if I just give them that money and set them off" - get a house, put a huge chunk in savings, get your medical set up, take your time to find your right path. Or, more realistically, more parents will just say "you won't have the money to pay that and neither will we, let's find an alternative".

This is what my father has to say about the news of Rush Limbaugh's passing.

This one really hurts...God bless you Rush. Thank you for your service to our country.

Hope he rots tbqh.

Right there with you TBH

ayayrawn

Well-Known Member

Your father is a perfect example of why Rush had an express ticket to hell.This is what my father has to say about the news of Rush Limbaugh's passing.

Nee Lewman

बैस्टर्ड

See @Twentytwo - this tweet lead to this guy not being in office anymore.Wild. From the mayor of Colorado City, TX. At least this piece of shit resigned.

View attachment 88584

dhodo

Well-Known Member

I think the juxtaposition of him leading by saying he won't take back what he said, but then closing by asking people to take back what they said is perfect.

Diaper Baby Escape Plan

Well-Known Diaper Baby

You should let him know Neil Peart was Canadian and died a year ago but that everyone mourns in their own time.This is what my father has to say about the news of Rush Limbaugh's passing.

And in the case that you haven’t responded yet you should make him think w all sincerity that you believe he is talking about the band

You should let him know Neil Peart was Canadian and died a year ago but that everyone mourns in their own time.

And in the case that you haven’t responded yet you should make him think w all sincerity that you believe he is talking about the band

Just trolled my father with this. Awaiting his reply.

This is what he responded to me with. No commentary based on my reply about Rush Limmbaugh.

This is what I had sent him:

I thought Neil Pert was a Canadian. And didn't he die a year ago or so?

Diaper Baby Escape Plan

Well-Known Diaper Baby

Ha ha. You know what they say: “when you can’t beat em, send them jokes about beating off”This is what he responded to me with. No commentary based on my reply about Rush Limmbaugh.

This is what I had sent him:

I’m paraphrasing but that’s the saying

Tyr

Well-Known Member

Fuck that guyWild. From the mayor of Colorado City, TX. At least this piece of shit resigned.

View attachment 88584

Reading through the AOC Twitter thread I do see that there are some Millennials that do not support the student loan relief.

Why? They have managed to pay off their student loans already and will get no benefit from the student loan forgiveness.

Example. One person who graduated in 2009 with 46k of student loan debt. Says he was able to pay it off in 11 years, but he had to work his ass off hard for it. Working 40 hours a week for 11 years straight 60 hours a week in the summers, lived at home the full time with his parents and didn't go on any vacations.

People like him are proposing that instead of forgiving an amount, they should be setting the interest rate of the predatory student loans to 0%, reverting the loans back to their original balance. And for those who already paid off their student loans, they should be getting a refund for the interest paid.

I hated how this guy implied that those with student loan trouble are lazy. And people called him out on that he is in a better financial situation than most who graduated in 2009. But as far as he is concerned. His propose for 0% interest is better and should be what the Dems do. And many people support him on that.

I don't think that plan works to solve the issue at all. It doesn't provide benefit now to anyone who actually needs it. Only people who don't need it. It still leaves people paying off their student loans for 10+ years.

Why? They have managed to pay off their student loans already and will get no benefit from the student loan forgiveness.

Example. One person who graduated in 2009 with 46k of student loan debt. Says he was able to pay it off in 11 years, but he had to work his ass off hard for it. Working 40 hours a week for 11 years straight 60 hours a week in the summers, lived at home the full time with his parents and didn't go on any vacations.

People like him are proposing that instead of forgiving an amount, they should be setting the interest rate of the predatory student loans to 0%, reverting the loans back to their original balance. And for those who already paid off their student loans, they should be getting a refund for the interest paid.

I hated how this guy implied that those with student loan trouble are lazy. And people called him out on that he is in a better financial situation than most who graduated in 2009. But as far as he is concerned. His propose for 0% interest is better and should be what the Dems do. And many people support him on that.

I don't think that plan works to solve the issue at all. It doesn't provide benefit now to anyone who actually needs it. Only people who don't need it. It still leaves people paying off their student loans for 10+ years.

wmeugene

Well-Known Member

I mean setting the interest for all students loans to 0 isn't nothing, but agreed that it won't do as much as loan forgiveness.Reading through the AOC Twitter thread I do see that there are some Millennials that do not support the student loan relief.

Why? They have managed to pay off their student loans already and will get no benefit from the student loan forgiveness.

Example. One person who graduated in 2009 with 46k of student loan debt. Says he was able to pay it off in 11 years, but he had to work his ass off hard for it. Working 40 hours a week for 11 years straight 60 hours a week in the summers, lived at home the full time with his parents and didn't go on any vacations.

People like him are proposing that instead of forgiving an amount, they should be setting the interest rate of the predatory student loans to 0%, reverting the loans back to their original balance. And for those who already paid off their student loans, they should be getting a refund for the interest paid.

I hated how this guy implied that those with student loan trouble are lazy. And people called him out on that he is in a better financial situation than most who graduated in 2009. But as far as he is concerned. His propose for 0% interest is better and should be what the Dems do. And many people support him on that.

I don't think that plan works to solve the issue at all. It doesn't provide benefit now to anyone who actually needs it. Only people who don't need it. It still leaves people paying off their student loans for 10+ years.

I don't understand those who don't want to help others even if they don't get the direct benefit. I graduated with almost a quarter million in student loans, and I'm down to about $90k. I won't likely receive any relief since I consolidated my federal loans with private student loans to drive the interest rates down. So be it, doesn't mean that others shouldn't get relief. I've been fortunate to be able to pay as much as I have, others aren't so fortunate.

I mean setting the interest for all students loans to 0 isn't nothing, but agreed that it won't do as much as loan forgiveness.

I don't understand those who don't want to help others even if they don't get the direct benefit. I graduated with almost a quarter million in student loans, and I'm down to about $90k. I won't likely receive any relief since I consolidated my federal loans with private student loans to drive the interest rates down. So be it, doesn't mean that others shouldn't get relief. I've been fortunate to be able to pay as much as I have, others aren't so fortunate.

The initial tweet by this guy basically said he doesn't support any student loan relief unless it benefits him.

And of course I love how he thinks he should get a refund for the interest he paid on his loans.

Yes, setting the interest rate to 0 is nothing. It will help pay off loans much faster. However it doesn't give anyone who is still paying $600 a month now any relief until they pay off their loans. Meanwhile those who did pay off their loans get a big check.

I love how those in a better financial position propose ideas that benefit them the most. And if it doesn't benefit them, they don't support it.

Talk about greed and being selfish.

I was debating posting this here or in the COVID thread. But I figure this is more of a political discussion.

On the West Coast, many local municipalities have started enacting hazard pay laws for front line workers such as grocery store workers.

Seattle is the latest city to enact hazard pay legislation which went in effect earlier this month. It pays workers an additional $4 an hour in hazard pay for the remaining duration of the pandemic.

We think this is good news right? A story about right being done by those working hard on the front lines?

Unfortunately, the opposite is true. For those that work at Kroger it has cost them their jobs.

Kroger announced they are closing their 2 Seattle locations and released the following statement.

These are just the latest 2 stores Kroger has closed over hazard pay requirements. Kroger has also closed other stores on the West Coast in recent months in municipalities that have also enacted hazard pay requirements. Long Beach and Montebello have also passed Hazard Pay requirements for grocery store workers. Kroger closed 2 stores in these locations earlier this month. A Ralphs location and a Food 4 Less, which are apparently other grocery store brands Kroger owns.

Los Angeles and Berkeley have proposes to introduce legislation to require hazard pay for grocery store workers. Kroger opposes and has threatened city council members that should they pass this it would result in Kroger likely having to close their locations in these cities.

www.cnn.com

www.cnn.com

On the West Coast, many local municipalities have started enacting hazard pay laws for front line workers such as grocery store workers.

Seattle is the latest city to enact hazard pay legislation which went in effect earlier this month. It pays workers an additional $4 an hour in hazard pay for the remaining duration of the pandemic.

We think this is good news right? A story about right being done by those working hard on the front lines?

Unfortunately, the opposite is true. For those that work at Kroger it has cost them their jobs.

Kroger announced they are closing their 2 Seattle locations and released the following statement.

"Unfortunately, Seattle City Council didn't consider that grocery stores — even in a pandemic — operate on razor-thin profit margins in a very competitive landscape," QFC said in a news release Tuesday. QFC said its operating costs have increased during the pandemic and there were "consistent financial losses" at the two stores. With the additional hazard pay requirement, "it becomes impossible to operate a financially sustainable business."

These are just the latest 2 stores Kroger has closed over hazard pay requirements. Kroger has also closed other stores on the West Coast in recent months in municipalities that have also enacted hazard pay requirements. Long Beach and Montebello have also passed Hazard Pay requirements for grocery store workers. Kroger closed 2 stores in these locations earlier this month. A Ralphs location and a Food 4 Less, which are apparently other grocery store brands Kroger owns.

Los Angeles and Berkeley have proposes to introduce legislation to require hazard pay for grocery store workers. Kroger opposes and has threatened city council members that should they pass this it would result in Kroger likely having to close their locations in these cities.

Kroger will close more stores over hazard pay laws for workers

Kroger will close two stores in Seattle over the city's $4-an-hour hazard pay requirement for grocery workers, an escalation of the grocery chain's push against newly-passed hazard pay laws growing on the West Coast.

Last edited: